The Anti-Martingale strategy involves doubling bets after wins and reducing them after losses, aiming to capitalize on winning streaks while minimizing risk. It’s most effective in trend-based scenarios, requiring discipline and careful risk management to navigate the inherent unpredictability of gambling and financial markets.

The Anti-Martingale Strategy, often referred to as the Reverse Martingale, is a popular approach in risk management, particularly in the fields of trading, gambling, and investment. This strategy is a direct counter to the traditional Martingale system, advocating for a completely opposite approach to stake management and profit realization.

Advantages and Disadvantages

- Capitalizes on Momentum: By increasing stakes during a winning streak, the Anti-Martingale maximizes profits from favorable trends.

- Limits Losses: Reducing or ceasing bets after a loss can prevent the rapid depletion of capital, a common risk in the Martingale Strategy.

- Encourages Discipline: The strategy requires a systematic approach to stake management, fostering discipline among practitioners.

- Dependent on Streaks: The effectiveness of the Anti-Martingale is heavily reliant on catching and sustaining winning streaks, which can be unpredictable.

- Missed Opportunities: After a loss, the conservative approach of reducing stakes may result in missed opportunities for recovery in volatile markets.

- Requires Winning Edge: Without a consistent winning strategy or edge, the Anti-Martingale Strategy cannot overcome the house edge in gambling or market inefficiencies in trading.

Understanding the Anti-Martingale Strategy

At its core, the Anti-Martingale Strategy involves doubling down on investments or bets following a win and reducing stake size or abstaining from betting after a loss. The premise is straightforward: capitalize on winning streaks and minimize losses during downturns.

Example in Trading

A trader starts with a $1,000 bet on a stock and wins, netting a 10% return. Employing the Anti-Martingale Strategy, they then invest $2,000 (the original stake plus the profit) in the next trade. If they win again, the stake for the subsequent trade would be $4,000, and so on, compounding their profits as long as their winning streak continues. Conversely, after a loss, the trader would either return to the initial stake amount or pause trading to avoid further losses.

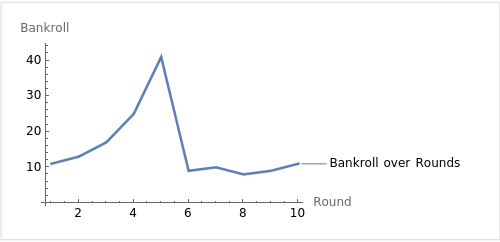

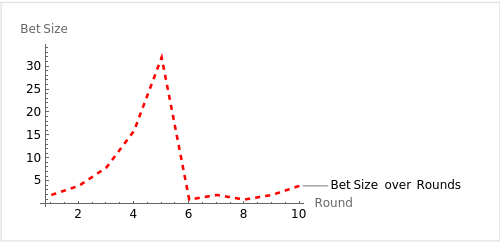

Detailed example in crash games

In this scenario, we apply the Anti-Martingale (Reverse Martingale) strategy to a crash game, starting with a $10 USD deposit and a $1 USD bet size. The strategy involves doubling the bet after each win and resetting to the initial bet after a loss. The winning payout is assumed to be 2x the bet for simplicity. Here’s a detailed description of each step over 10 rounds:

- Round 1: Won. Bet was $1 USD. Won $1 USD. Bankroll is now $11 USD.

- Round 2: Won. Bet was $2 USD. Won $2 USD. Bankroll is now $13 USD.

- Round 3: Won. Bet was $4 USD. Won $4 USD. Bankroll is now $17 USD.

- Round 4: Won. Bet was $8 USD. Won $8 USD. Bankroll is now $25 USD.

- Round 5: Won. Bet was $16 USD. Won $16 USD. Bankroll is now $41 USD.

- Round 6: Lost. Bet was $32 USD. Bankroll is now $9 USD.

- Round 7: Won. Bet was $1 USD. Won $1 USD. Bankroll is now $10 USD.

- Round 8: Lost. Bet was $2 USD. Bankroll is now $8 USD.

- Round 9: Won. Bet was $1 USD. Won $1 USD. Bankroll is now $9 USD.

- Round 10: Won. Bet was $2 USD. Won $2 USD. Bankroll is now $11 USD.

Graphs:

This graph shows the progression of the bankroll over 10 rounds, highlighting the fluctuations due to wins and losses under the Anti-Martingale strategy.

The bet size graph depicts how the bet is adjusted according to the Anti-Martingale strategy, doubling after wins and resetting after losses.

Scenario Description:

This scenario illustrates the Anti-Martingale strategy’s effect on the bet size and bankroll over 10 rounds of a simulated crash game. The bankroll experiences growth through consecutive wins but faces significant risk from losses due to the strategy’s nature of increasing bet sizes after wins. The detailed step-by-step description shows the outcome of each round, including the bet size, win amount, and resulting bankroll. The strategy showcases potential for profit but also highlights the risk of substantial loss if a losing round occurs after a series of wins, emphasizing the importance of careful bankroll management and risk assessment in gambling strategies.

Comparison with Other Strategies

- Martingale Strategy: The Martingale Strategy is the antithesis of the Anti-Martingale, advocating for doubling the bet size after a loss in an attempt to recover previous losses and gain a small profit. While the Martingale is beneficial in scenarios with a high probability of eventually winning, it risks significant losses in prolonged losing streaks.

- Fixed Stake Strategy: Unlike the variable stake strategies (Martingale and Anti-Martingale), the Fixed Stake Strategy involves betting a constant amount regardless of winning or losing streaks. This method is simpler and can be less risky but may result in lower profits during a winning streak.

- Kelly Criterion: The Kelly Criterion is a more complex strategy that determines the optimal bet size by considering both the probability of winning and the potential value of the bet. It aims to maximize the expected logarithm of wealth, which can lead to higher long-term growth compared to the Anti-Martingale.

FAQ

What are the potential benefits of using the Anti-Martingale strategy in gambling or trading?

The Anti-Martingale, or Reverse Martingale, strategy has several potential benefits when applied to gambling or trading, primarily revolving around capital protection and profit maximization under certain conditions. Here’s a simplified yet expert overview of its advantages:

- Capital Preservation: By resetting the bet to the initial amount after a loss, the strategy helps limit losses to manageable levels. This aspect is crucial in protecting the bankroll from rapid depletion, a common risk in aggressive betting or trading strategies.

- Exploitation of Winning Streaks: The strategy aims to capitalize on consecutive wins by doubling the bet after each win, potentially multiplying profits during periods of favorable outcomes. This can be particularly effective in scenarios where the gambler or trader has a strong edge or when market conditions are favorable.

- Risk Management: Since the strategy involves increasing bets during winning streaks and decreasing them after losses, it naturally incorporates a form of risk management. The potential losses are contained by not committing a significant portion of the bankroll after a losing streak, thus avoiding the risk of doubling down on losses.

- Psychological Comfort: The fear of loss is a significant factor in decision-making under risk. By ensuring that bets are only increased after wins, the Anti-Martingale strategy can provide psychological comfort or confidence to the gambler or trader, as they are essentially using “house money” to increase their bets.

- Simplicity and Discipline: The strategy is straightforward to implement, requiring no complex calculations or decision-making processes. This simplicity can help maintain discipline in betting or trading, preventing the common pitfall of emotional decision-making.

- Self-limiting Losses: The strategy inherently limits the size of losses to a fraction of the bankroll, since after a loss, the bet size is reset. This self-limiting feature helps in long-term bankroll management and sustainability.

What risks are associated with the Anti-Martingale strategy?

The Anti-Martingale strategy, while offering potential benefits, also carries specific risks:

- Dependency on Streaks: The strategy’s success heavily relies on winning streaks. A lack of consecutive wins makes it difficult to capitalize on the strategy’s potential for exponential growth.

- Limited Loss Recovery: After a loss, the strategy resets bets to the initial size, making it challenging to recover from significant losses without another sequence of wins.

- Market Volatility: In trading, market conditions can change rapidly. The strategy’s assumption that wins will continue in a streak may not align with market reality, leading to potential losses.

- Risk of Significant Loss: While the strategy aims to protect the bankroll by reducing bet sizes after losses, a significant loss after a series of wins can still deplete the accumulated profits, essentially erasing the gains from winning streaks.

What mathematical models can be used to analyze the Anti-Martingale strategy?

Several mathematical models can be used to analyze the Anti-Martingale strategy effectively:

- Probability Theory: This involves calculating the odds of consecutive wins or losses and their impact on overall returns, helping to understand the expected outcome of applying the strategy over a series of bets or trades.

- Stochastic Processes: Models like Random Walks and Markov Chains can simulate the random nature of betting or trading outcomes, providing insights into the likelihood and impact of winning and losing streaks under the Anti-Martingale strategy.

- Risk Analysis: Techniques like Monte Carlo simulations can be used to assess the risk and potential drawdowns associated with the strategy by simulating thousands of scenarios to understand the range of possible outcomes.

- Geometric Brownian Motion (GBM): In financial markets, GBM can model stock price movements, helping to analyze the effects of doubling down on wins in a volatile market.

These models help quantify the risks and potential rewards associated with the Anti-Martingale strategy, providing a statistical foundation for decision-making.

Are there any real-world examples or case studies of the Anti-Martingale strategy being used successfully?

Real-world examples or case studies of the Anti-Martingale strategy being used successfully are most commonly found in the domains of trading and gambling:

- Trading: Some traders apply the Anti-Martingale strategy by increasing their investment size after successful trades and reducing it after losses. This can be seen in trend-following or momentum trading, where traders capitalize on securities moving in a strong direction and cut losses quickly on adverse movements.

- Gambling: In casino games with close to even odds (e.g., betting on black or red in roulette), players sometimes use the Anti-Martingale strategy to attempt to maximize winnings during streaks of luck. While casinos have maximum bet limits that cap the strategy’s potential, there have been anecdotal reports of players temporarily benefiting from such streaks.

However, it’s important to note that while there are individual anecdotes of success, these examples should not be taken as evidence of the strategy’s effectiveness as a guaranteed approach to profit. Success stories often highlight periods of favorable outcomes without accounting for the risks and potential for loss inherent in any strategy based on chance or market conditions.

In which scenarios or markets is the Anti-Martingale strategy most effective?

The Anti-Martingale strategy can be most effective in scenarios or markets characterized by clear trends or momentum, where consecutive wins are more likely. Here are some contexts where it might be particularly applicable:

- Trend-Following in Trading: In financial markets that are experiencing a strong and clear trend, either upward or downward, traders might find the Anti-Martingale strategy effective. By increasing their investment size following a win, they can potentially capitalize on the continued movement in the market’s direction.

- Sports Betting: In scenarios where an individual or team has a clear and consistent winning streak, bettors might use the Anti-Martingale strategy to increase their stakes on subsequent bets, anticipating continued success.

- Casino Games with Close to Even Odds: Games that offer bets with close to a 50/50 chance of winning, such as betting on red or black in roulette, can be suitable for this strategy during short sessions where a player aims to exploit a winning streak.

- Momentum Investing: Similar to trend-following, momentum investing involves capitalizing on the continuation of existing market trends. The Anti-Martingale strategy can be applied here, with investors increasing their position sizes in assets that have shown strong recent performance.

It’s important to note, however, that the effectiveness of the Anti-Martingale strategy in these scenarios still heavily relies on timing and the ability to correctly identify when a winning streak might end. The strategy requires discipline and a clear plan for taking profits or cutting losses before potential reversals in the trend.

Written by

Author

Born in the heart of Serbia in 1984, Mirco Savich’s life story is a testament to dedication, passion, and relentless pursuit of expertise. Serbia, with its rich history and vibrant culture, laid the foundational stone for Mirco’s early life. But it was during his academic years at a Serbian university that he discovered an enthusiasm that would come to define his professional journey – gambling. Mirco developed a particular fondness for crash games. Titles like JetX, Aviator, and JetX3 not only piqued his interest but became his specialization.